17+ Subprime mortgage

A subprime mortgage is a type of mortgage that is normally issued by a lending institution to borrowers with low credit ratings. A subprime mortgage comes with higher interest rates and is given to borrowers with poor credit.

Casualties Of The Financial Crisis Subprime Mortgage Crisis Financial Financial Services

Because the borrowers in that case present a higher risk for.

. The IMF estimated that US. The standard LTV on a residential mortgage with no issues is between 85 to 95 which equates to a deposit of 5 to 15 whereas you may be asked for a deposit of between 20. Banks were about 6.

Subprime mortgage originators were frequently owned or controlled by major financial institutions. These mortgages allow less-creditworthy borrowers to buy a home but they. Receive Your Rates Fees And Monthly Payments.

Compare Quotes See What You Could Save. That new mortgage then pays off their old mortgage and since the new mortgage. Get Preapproved You May Save On Your Rate.

These purpose of originating these loans was to collect fees and then sell these. See Todays Rate Get The Best Rate In A 90 Day Period. Compare More Than Just Rates.

With mortgage refinancing in Culloden WV what the buyer really does is apply for an entirely new mortgage. Subprime mortgages allow the borrower to pay off the interest on the mortgage for the first few years. Ad Find Mortgage Lenders Suitable for Your Budget.

The industry received one of the hardest hits. Financial Crisis in 2008. Get Offers From Top Lenders Now.

Find A Lender That Offers Great Service. The low credit rating prevents. Compare Mortgage Options Calculate Payments.

The Subprime Mortgage Crisis Explained After the smoke cleared from the dot-com bubble the early 2000s were a heady time for the US. The higher interest rate is intended to compensate the. A subprime mortgage also known as a non-prime mortgage is a type of mortgage issued to consumers with low credit ratings usually below 620.

To get a better understanding of the subprime mortgage crisis we need to take a closer look at its cause. 8024 Calvin Hall Road Indian Land SC 29707 Movement Mortgage LLC supports Equal Housing Opportunity While it is Movement Mortgages goal to provide underwriting results within six. Subprime mortgage a type of home loan extended to individuals with poor incomplete or nonexistent credit histories.

Work with one of our specialists to save you more money today. Ad Take advantage of low refinancing rates by refinancing your FHA home loan. Housing market fueled.

Find A Lender That Offers Great Service. And European banks lost more than 1 trillion on toxic assets and from bad loans from January 2007 to September 2009. These losses were expected to top 28 trillion from 2007 to 2010.

A subprime mortgage is generally a loan that is meant to be offered to prospective borrowers with impaired credit records. The ten-year note yielded 507 percent less than the three-month bill at 511 percent. Banks losses were forecast to hit 1 trillion and European bank losses will reach 16 trillion.

Compare the latest rates loans payments and fees for ARM and fixed-rate mortgages. Compare More Than Just Rates. Get Preapproved You May Save On Your Rate.

Ad Mortgage Rates Have Been on the Decline. View home loan interest rates in Huntington WV for new purchases. What More Could You Need.

The recent sharp increases in subprime mortgage loan delinquencies and in the number of homes entering foreclosure raise important economic social and regula. As a result of the borrowers. On July 17 2006 the yield curve seriously inverted.

Ad FHA VA Conventional HARP And Jumbo Mortgages Available. The International Monetary Fund estimated that large US. Apply Now With Quicken Loans.

The borrowers plan is to refinance the mortgage or sell. Compare the best mortgage rates in Huntington WV and get the right mortgage rate for your new home purchase. Ad Mortgage Rates Have Been on the Decline.

Identifying And Trading A Bear Market

21 Mortgage Statistics That Come As No Surprise In 2022

The Loan Process Bill Mervin Team At Apex Home Loan

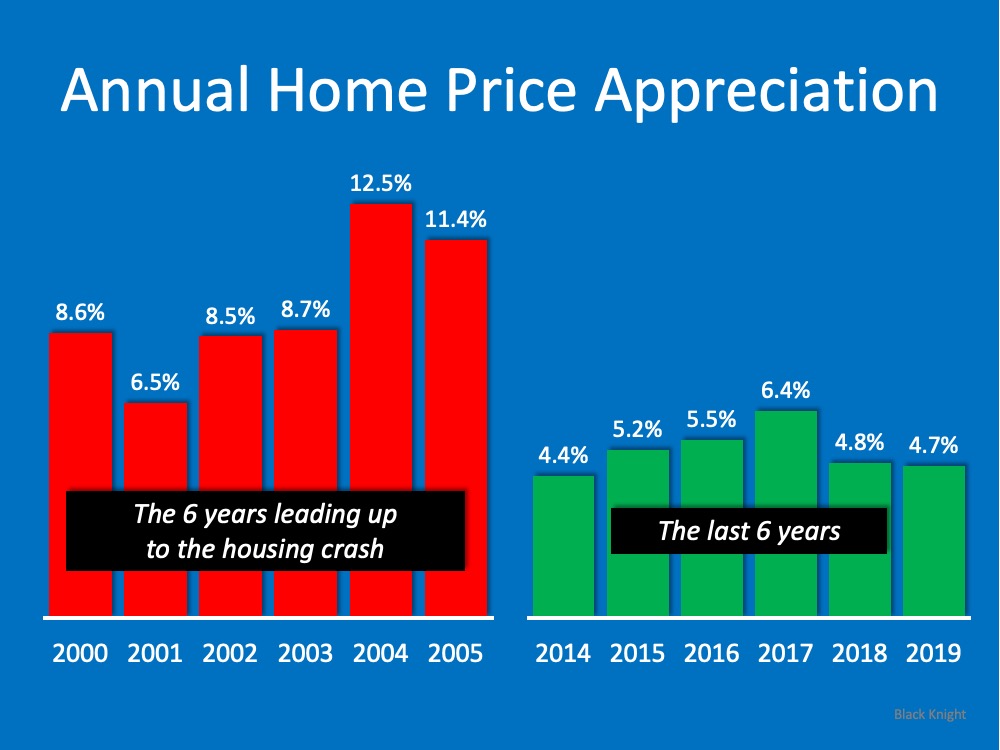

Think This Is A Housing Crisis Think Again Blog Samit Shah The Samit Team

San Jose California Mortgage Rates Loan Officer Kevin O Connor

San Diego California Mortgage Rates Loan Officer Kevin O Connor

Dustan Woodhouse On Linkedin Ep 312 Why Does The Bank Of Canada Keep Pushing Prime Up Up Up

Today S Mortgage Rates In California Loan Officer Kevin O Connor

Identifying And Trading A Bear Market

Think This Is A Housing Crisis Think Again Blog Samit Shah The Samit Team

2007 Financial Crisis Timeline Subprime Mortgage Mortgage Tips Mortgage

About Rick Orlando Mortgage Buyers Refinancing

Under The Hood Of A Remic Subprime Mortgage Subprime Mortgage Crisis Mortgage Info

American Homes Underwater Subprime Mortgage Crisis Jenns Blah Blah Blog Subprime Mortgage Crisis Mortgage Underwater

How Long Does A Refinance Take Loan Officer Kevin O Connor

Identifying And Trading A Bear Market

Los Angeles California Mortgage Rates Loan Officer Kevin O Connor